Earn 1% on Qualifying Purchases while using Apple Pay

RIVERWOODS, Ill.--(BUSINESS WIRE)--

Discover

Cashback Debit customers are now able to add their Cashback Debit

card to Apple Pay® and earn 1% cashback on eligible

transactions. Apple Pay is an easy, secure and private way to make

payments in participating stores, apps and websites.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20181011005140/en/

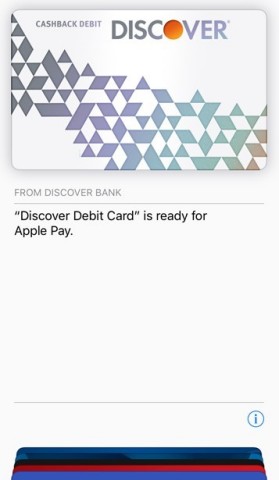

Discover Cashback Debit on Apple Pay® (Photo: Business Wire)

“Enabling Apple Pay for Discover Cashback Debit is a key step to ensure

our customers are able to use their checking account in channels of

their choice, including their mobile devices,” said Arijit Roy, vice

president of Deposits at Discover. “Our customers now have one more way

to earn rewards as they use their Cashback Debit card for purchases.”

While using a Discover Cashback Debit card with Apple Pay, customers

will continue to receive 1% cashback on up to $3,000 in qualifying debit

card purchases each month1 and have access to all of the

benefits that come with the Discover Cashback Debit account including:

-

First Fee Forgiveness2 which automatically waives the first

eligible fee when it occurs each calendar year, with no action

required by the customer

-

Freeze it℠ feature: Temporarily freeze your debit card to prevent new

purchases and ATM transactions3

-

No monthly fees, including no minimum opening deposit or balance

requirement

-

24/7 customer service from a 100% U.S.-based customer service team

-

No-fee online bill pay

How to Add a Discover Cashback Debit card to Apple Pay

Apple Pay is easy to set up for Discover Cashback Debit customers with

Apple devices. On your iPhone, simply go to the Wallet app to add your

Discover Cashback Debit card. To make Cashback Debit your default card,

tap and hold your Discover debit card and drag it to the front of your

card stack in Wallet.

Security and privacy is at the core of Apple Pay. When you use a credit

or debit card with Apple Pay, the actual card numbers are not stored on

the device, nor on Apple servers. Instead, a unique Device Account

Number is assigned, encrypted and securely stored in the Secure Element

on your device. Each transaction is authorized with a one-time unique

dynamic security code.

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and payment

services company with one of the most recognized brands in U.S.

financial services. Since its inception in 1986, the company has become

one of the largest card issuers in the United States. The company issues

the Discover card, America's cash rewards pioneer, and offers private

student loans, personal loans, home equity loans, checking and savings

accounts and certificates of deposit through its direct banking

business. It operates the Discover Global Network comprised of Discover

Network, with millions of merchant and cash access locations; PULSE, one

of the nation's leading ATM/debit networks; and Diners Club

International, a global payments network with acceptance in 190

countries and territories. For more information, visit www.discover.com/company.

Discover Bank, Member FDIC

1 ATM transactions, the purchase of money orders or

other cash equivalents, cash over portions of point-of-sale

transactions, Peer-to-Peer (P2P) payments (such as Apple Pay Cash), and

loan payments or account funding made with your debit card are not

eligible for cash back rewards. In addition, purchases made using

third-party payment accounts (services such as Venmo® and PayPal™, who

also provide P2P payments) may not be eligible for cash back rewards.

2In each calendar year (January 1 through December 31), the

first eligible fee charged to your Cashback Debit Account will be

automatically waived and credited to your account. Insufficient Funds

and Stop Payment fees are eligible for the first fee forgiveness

program. Wire transfer fees are not eligible, and will not be waived

even if they are the first fee on an account in a calendar year.

3When you freeze your debit card, Discover will not authorize

new purchases, or ATM transactions with that frozen debit card. Most

other account activity will continue as normal, including previously

scheduled and recurring transactions, internal and external transfers,

deposits, online bill payments from the Discover Account Center,

returns, credits, dispute adjustments, reward redemptions, and checks

paid.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20181011005140/en/

Discover

Rob Weiss

224-405-6304

robertweiss@discover.com

@Discover_News

Source: Discover Financial Services